Over the last two decades, Brandy Borts has moved more than 40 times but she is thankful to have housing at all in one of the most expensive counties in the country. Each night, she goes home to an apartment she has inhabited for five years—her longest stint in town. The building is thick with black mold and has asbestos in the paint. She was sick for the majority of the winter.

Although Borts doesn’t have a lease and hasn’t been able to reach her landlord during the COVID-19 pandemic, she is grateful that her building was not torn down in April as planned, and that she hasn’t been kicked out. Construction was stalled in her neighborhood due to the COVID-19 pandemic. She says she feels fortunate to have a home, however unstable the situation but she is “very nervous” to lose the roof over her head.

Like Borts, many renters aren’t sure where to turn for relief. Wyoming renters and homeowners alike could face hefty bills post COVID-19, compromised credit, potential food insecurity, and for some, the prospect of homelessness.

The U.S. House of Representatives on May 15 approved the Health and Economic Recovery Omnibus Emergency Solutions Act—the most ambitious economic relief response to the novel coronavirus yet. The $3 trillion legislation designates $100 billion for emergency rental assistance and eviction protection, along with $75 billion of direct assistance for mortgage payments and other housing costs. But the bill remains stalled in the Senate.

Borts says she lucked out because while her housing is unstable, it is at least affordable, even amid the pandemic. That means she is not among the 286 households across Wyoming that have applied for renter relief through the CARES Act.

Under the Wyoming Emergency Housing Assistance Program, the Wyoming Community Development Authority (WCDA) on June 4 released an application process for financial assistance. Available to Wyoming renters and homeowners that have experienced a substantial loss of income due to COVID-19, the Wyoming Legislature allocated $15 million for the program.

Casper-based WCDA is allocating the funds to qualifying applicants whose current monthly gross household income must be equal to or less than roughly $20,000. On Thursday, 192 submissions were finalized. Applicant demographics so far paint a picture of need in Teton County—62 applications came from valley residents. The agency sent out 64 initial payouts this week totaling $65,150.

Paycheck-to-Paycheck

Jackson residents are no strangers to the trials of housing or food insecurity, multilayered problems exacerbated by the pandemic. Most renters were reluctant to speak to KHOL for this story, fearful of losing their housing or retribution from their landlords.

It’s a tenuous situation for many locals whose budgets just don’t fit the bill.

The cost of living in Teton County is 61 percent higher than the statewide average, according to Wyoming’s Cost of Living Index. The culprit: housing, which weighs in at 48.4 percent, the largest of six categories measured by the state’s Economic Analysis Division.

Housing costs, meanwhile, continue to rise. Rental rates rose 6.5 percent for apartments and 2.7 percent for houses last year in Teton County. Median family income increased by 8.3 percent in 2019, but that is in contrast to only 3.7 percent in 2018, according to the Department of Housing and Urban Development. The subtext to this data: Teton County leads the nation in per capita income and that is skewed by the county’s top earners. In other words, the rise in median income does not reflect the reality of what “average” folks are bringing home. “Teton County’s unprecedented-in-world-history income levels are due to its unprecedented-in-world-history levels of investment income,” wrote economist and Jackson Town Councilor Jonathan Schechter on his blog Cothrive.

A window into those average earners’ realities: In January, 1,190 county households (or 2,586 people) had applications for affordable housing on file with the Housing Department. More than four hundred of those were cost-burdened, meaning that more than 30 percent of their income went toward housing.

For those out of work due to COVID, this is unmanageable. In May, 15 percent of Teton County residents were unemployed, according to the Wyoming Department of Workforce Services. Compare that to the county’s 2.9 percent unemployment rate in May 2019.

“We are stuck. There is nowhere to go.”

During the shutdown, Renee Knutson remembers crying a handful of times when she left the grocery store. Her hours had just been cut at her job providing after-school support to students and she was stunned by the increasing cost of basic staples. Now she and her husband are taking advantage of food resources. Every Wednesday they pick up free dinner from the Presbyterian church.

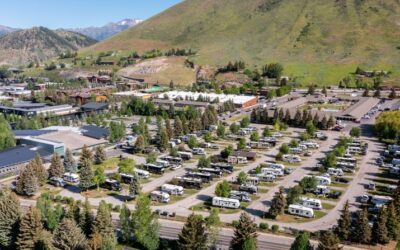

The couple has rented at Blair Place for seven years. When they moved into their two-bed, two-bath abode, they were paying $1,250 per month. A few years later, their rent jumped to $1,890—more than 25 percent of their income.

When their one-year lease ran out toward the beginning of the pandemic, they had to make some hard choices. Their landlord, Todd Oliver, stepped in to help, allowing a month-to-month agreement that honored their current rate, and lowering the planned price increase for their unit.

Oliver acknowledges housing is not optional. He is working with his tenants because “people have to have a place to lay their heads at night.”

Given the contentious history of rental hikes at the complex—Oliver raised rents roughly 40 percent in 2015—the halt on rent increases and price freezes alone was “huge,” Knutson said. Living paycheck-to-paycheck, the couple had one less thing to worry about.

Meanwhile, Knutson’s husband continues to search for affordable, long-term housing in his spare time but anything in the couple’s price range is typically gone before they can arrange a showing around their work schedules.

Renee Knutson, right, and her husband Matt Grabowski have weathered the rental storm at Blair Place Apartments. Their landlord is working with them through the pandemic but they dream about homeownership. (Robyn Vincent/file photo)

Knutson was unaware of the application process for funding help, but suspects she and her husband wouldn’t be eligible for assistance since they have been living off his income as a full-time employee for UPS. The couple has never qualified for affordable housing through the Housing Authority or the Housing Trust.

To qualify for affordable properties, applicants must earn less than 120 percent of median family income, determined by the U.S. Department of Housing and Urban Development for Teton County. As of April 2020, for two people, that range is $44,380 to $106,272. Residents who earn more than 120 percent of the MFI but still cannot afford to purchase a market home can apply under the workforce program. Applicants must earn 75 percent of their income locally.

Knutson says the department has changed its policy over the years and at different times the couple has not qualified based on their income being too high or too low. To top it off, rentals are hard to come by—the vacancy rate throughout the valley was less than 6 percent in November 2019, according to the Jackson and Teton County Housing Supply plan.

The average rent for a two-bedroom apartment in Teton County is $2,274, the highest in the state. That means a household needs to earn at least $90,000 annually to afford an average two-bedroom apartment.

These figures leave Knutson, and many locals like her, with few options. Faith and tenacity, she says, are her only fallbacks. “We are stuck. There is nowhere to go.”

Answering the Call in a Time of Crisis

Under the emergency housing program, the state could shell out up to $2,000 in assistance per month for renters and homeowners, which will be directly paid to landlords and mortgage lenders. Eligible funds can be applied to rent fees due in June and to past-due payments from the pandemic months of April and May.

The WCDA will provide the difference between 30 percent of the household’s current gross monthly income and eligible housing assistance costs up to the monthly cap. For unemployed folks, it will foot the entire bill, but unemployment payouts count toward income.

Just how far will the state-appropriated funds stretch?

If all the disbursements were made at the maximum amount of $2,000, 7,500 Wyoming residents could collect aid, Scott Hoversland, executive director of WCDA, said. But at a lower rate—like $1,500—it would mean the WCDA could disperse 10,000 payouts.

Funds could potentially last through December 31, Hoversland said, if the organization’s coffers don’t dry up or the governor doesn’t cut off assistance first.

Landlords, on the other hand, could find it hard to get their footing again without an additional small business loan to make up lost costs, especially if their tenants don’t seek assistance.

Still, Hoversland hopes the funds will bridge the gap until applicants return to their jobs. Ideally, the aid will avoid the need to catch up on three months of rent at once.

April Norton, director of the Jackson/Teton County Affordable Housing Department, is working closely with the WCDA and several community organizations to assist Jacksonites. She recognizes people have had their hours cut and says she plans to make exceptions so they don’t lose their eligibility amid a global pandemic.

“Many families and individuals who were behind in rent before COVID hit are now many months behind and their landlord is in a tough position,” Norton said. “There are people who make all their money in the summer and now they can’t depend on that either. Ultimately, $15 million for rent and mortgage relief will not stretch that far.”

The roadblocks are seemingly endless for struggling renters. Returning to work without child care is impossible for many families. Some folks have even had their rent raised during the crisis, Norton said. And it’s not just low-wage earners who are affected.

“We are all humans. We are all people. We all count,” Norton said. “Housing insecurity is one piece of this, but food insecurity and the stress of not knowing what tomorrow or next month is going to bring is another huge piece, whether you are a single person or a family of five.”

“Housing insecurity is one piece of this, but food insecurity and the stress of not knowing what tomorrow or next month is going to bring is another huge piece, whether you are a single person or a family of five.”

Many social service providers have come together to address the crisis. The Housing Authority has been working alongside One22, Teton County Health Department and the Community Safety Network, to name just a few. They are helping to coordinate resources, along with local hoteliers to provide access to rooms where people can self-isolate or quarantine.

People working in these spheres say the need is overwhelming.

Between March 20 and May 27, more than 3,000 households requested financial aid from One22, said executive director Sharel Lund. “That number represents over 6,000 people. It’s a huge percentage of the community,” Lund said. At the time, the CARES Act had not been approved, unemployment insurance had not been expanded, and many people were still awaiting their federal stimulus checks.

In April and May, that need was still tremendous. During those two months, One22 provided $2 million in financial awards to community members who live and work in Teton County. Lund says the organization is not designed for that kind of caseload.

“Both tenants and landlords need to know the scale of assistance that is being asked of us in terms of rent expenses,” she said. “If tenants understand that 3,000 households aren’t able to pay the rent and 3,000 landlords understand that many can’t pay in full, it helps both parties.”

One22 has relied heavily on the emergency response fund launched by the Community Foundation, which raised $2.5 million.

These are uncharted waters for the organization, Lund said, which in a normal year provides 125 to 150 people with a one-time financial aid award for one month. “We have all the systems in place,” she said, “but not the scale.”

Local landlords are facing similar struggles.

Blair Place owner Todd Oliver’s 300-unit complex is now at its lowest occupancy rate in 12 years. He has compromised the typical “summer surge,” which represents a significant piece of lost revenue. As Knutson noted, Oliver has halted and reversed rent increases. He also has canceled late fees and penalties for his tenants and is not evicting anyone for financial reasons.

But enacting those policies hasn’t been easy. The pandemic hit at the same time property taxes, annual insurance premiums and his mortgage were due. When a couple of flooded toilets caused extensive damage, Oliver had to scramble to balance his budget and maintain the property.

A few tenants have had to renege on their lease agreements, but Oliver negotiated with them and did not exercise early termination fees. He has also partnered with Hole Food Rescue to help struggling tenants access free food resources.

“It takes a community,” he said. “The priorities have to be shelter, food and health.”

But Oliver says he is confused about the WCDA’s program, although he has invested significant time participating in conversations with local agencies and legislators about relief efforts, resources and legislation. He hopes it will be helpful to many Wyomingites, but isn’t sure how the WCDA procedures comply with legislation.

Ballots and bailouts

Housing advocacy group Shelter JH is talking policy with elected leaders, housing influencers, and local workers to keep a pulse on the barriers facing tenants in the age of COVID.

“Election season is imminent, and it is imperative that we elect housing champions to local offices,” said coordinator Clare Stumpf.

The organization’s 501c4 status allows it to endorse candidates. On their Instagram page, Shelter JH advocates for creative solutions to the housing crisis, like a bill that would charge second homeowners a fee and incentivize them to rent their properties instead of leaving them empty. The legislation, sponsored by Jackson Rep. Mike Yin, did not make it out of a legislative committee last November but drew a robust response from local residents eager to find answers to the valley’s housing problems.

“It is imperative we elect housing champions to local office.”

Shelter JH has reached out to housing director Norton and state legislators to discuss affordable housing initiatives and the CARES Act. One further measure the state made in late March: the Wyoming Public Services Commission voted to suspend discontinuation of services, late fees and tariffs related to public services utilities during COVID.

Every week, the organization participates in a housing group—alongside representatives from social services organizations including One22 and the Community Foundation—to discuss updates in local relief efforts and housing challenges. There, the group advocates for renter rights, including a halt on evictions and rent relief during COVID. Advocates have also shared concerns from renters with the Housing Department in hopes it will negotiate with landlords to address pertinent problems.

No vacancy

Despite advocacy efforts and policy reform, some Wyoming residents have been left out in the cold.

Wren Fialka, founder of Spread the Love Commission, watched as “the need grew exponentially almost overnight.” She remembers when she got a call from a man living in another part of Wyoming who had lost his job and was standing out in the rain. He had slept under a bridge without enough room to lay down after being turned away from every church and shelter he tried.

When the pandemic hit, Fialka says she too had barely enough to keep the lights on, but a $2,500 grant from the Community Foundation and an “angel donor” came to the rescue, which allowed her grassroots organization to distribute supplies—including health and hygiene packets, clothing, food, sleeping bags and blankets—to more than 3,000 individuals and families in Teton County, the Wind River Reservation and Salt Lake City in April and May. The number totaled more than her usual scope in a year.

“It really illustrates how close everyone is to being housing insecure,” she said. “The first people threatened by this were people who were already vulnerable.”

Many transient folks faced a bleak reality during the pandemic. At the Good Samaritan Mission in Jackson, COVID restrictions required testing prior to people’s admission from March 30 through June 1, restrictive barriers that made entry even harder. Currently, one woman and 10 men are residing at the shelter. Like everyone else, transient people, who often comprise the shelter’s population, are not traveling, executive director Chuck Fidroeff said. Normally, the shelter is at capacity this time of year: five women and 30 men.

Now I lay me down to sleep

Knutson and her husband continue to search for affordable housing outside city limits but they keep coming up short, and their “beater valley cars” won’t make the commute over Teton Pass. “We have been investing in this community for a long time, but it doesn’t make sense to stay here,” Knutson said. “Now my husband has a career, so we are going to pay what we have to pay to stay. It is starting to feel like learned helplessness.”

While complexes such as Aspen Meadows and Blair Place have postponed planned rent hikes, local advocates like Stumpf agree that the problem runs much deeper. COVID has broken down fundamental systems of the local economy, Stumpf said. She hopes the community will reflect on the entire housing system to define solutions to what she calls “entrenched problems” already affecting locals pre-COVID, including sky-high rent and purchase prices for housing.

But housing advocates say it’s hard to know what is next in terms of policy or pandemonium, especially with a federal moratorium on evictions set to expire July 25.

Borts, meanwhile, has been on the list for affordable housing with the Housing Authority for 18 years, and she has been signed up with the Housing Trust for 14 years. She works full time and still has not qualified for housing. For her, a place to rest is all that really matters.

“If you have a place to live in Jackson, you don’t complain,” she said. “I’m just holding on as long as I can.”

How to apply for federal aid through the Wyoming Emergency Housing Assistance Program

The program application is available at wyocares.org or on the WCDA website.

For assistance completing the WEHAP application, contact the WCDA, WEHAPHelps@wyomcingcda.com; 307-253-1089 or the Jackson/Teton County Housing Department, housing@tetoncountywy.org; 307-732-0867.