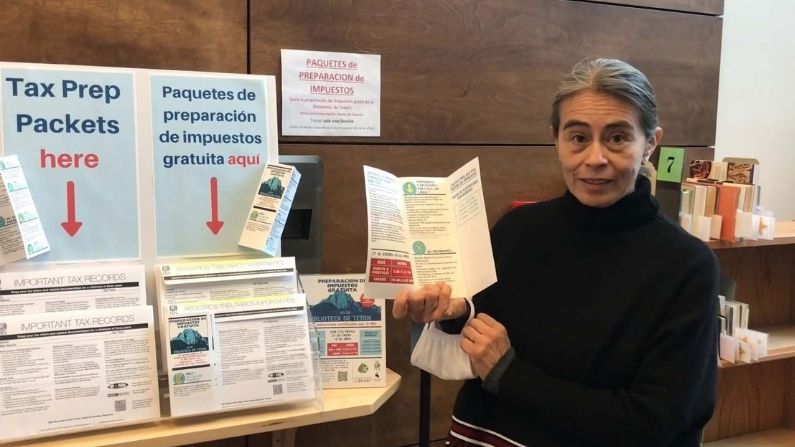

With stimulus checks, extra unemployment benefits and a new deadline, many people have more questions than normal about filing their taxes this year. KHOL Spanish-language reporter Alicia Unger has been reporting on how the free, bilingual Teton County Library tax prep program is continuing to operate despite the pandemic, along with other changes that everyone should know about.

KHOL News Director Kyle Mackie interviewed Unger about her reporting. Unger’s full story is also available to listen to in Spanish.

KYLE MACKIE: Alicia, it is that time of year again. It’s tax season. Tell me about your reporting and what kind of questions you were trying to answer.

ALICIA UNGER: Yes, it’s a very complicated year. People have received different unemployment checks; They have a lot of questions. And at the same time, I found out that the Teton County Library is able to help the residents who need help in filing their tax forms. However, they also have [had to make] change[s] and they have [had] to take measures in order to protect the public and their employees, as well as volunteers who prepare the taxes forms. So, I thought it was very interesting for me to tell the public what is being done and, at the same time, [to] answer the questions that they may have.

Dan Butcher, a volunteer for the free VITA tax prep program offered by the Teton County Library, works with a client car-side in the library’s north parking lot. (Courtesy of Teton County Library)

But the most important thing also, I think, is that there are new rules that the IRS [Internal Revenue Service] have taken that will help the community to prepare their taxes this year. The number one is that they changed the date. The deadline to present your taxes form. Normally, the deadline is from April 15, and now it is May 17. Not only that, but if they didn’t get their two checks, stimulus checks, now they’re going to be able to apply to get them back as a reimbursement.

MACKIE: So, let me ask you a couple of quick questions. First of all, stimulus checks. What did you find about that in your reporting? I know there are some questions out there. Stimulus checks are not taxable at all, right?

UNGER: Correct. They are not taxable at all. And they don’t have to tell about it in the forms. However, only if you didn’t get one or the other or you just got partially [a partial amount], but you know that you’re qualified for them, then in the form there is an area where you’re going to be able to apply for the reimbursement. The unemployment checks: You have to put it in the form. Now, not all of the amount you receive applies to taxes. According to the IRS spokesperson, all unemployment checks up to $10,200 will be not taxable. They won’t have to pay taxes.

MACKIE: Okay, so anyone who got unemployment benefits last year has to declare what they earned but that first $10,200 is not taxable. Is that right?

UNGER: Correct.

MACKIE: Okay great. And as you mentioned, you spoke to the IRS, to a spokesperson for this story. What did you learn from her?

UNGER: Well, I learned all this information, plus that the VITA program, which is the program that the library currently uses, is certified by them. There are professionals trained by the IRS and they’re here to help the community, and they do it for free. One of the [pieces of] advice that the spokesperson told me—her name is Irma Trevino—Trevino told me that sometimes people hear that they can get more money somewhere else and that can get them in big problems. So, do not believe in people who tell you that you can get more money than you should.

MACKIE: Got it. Yeah, we all wish that our return was sometimes longer than it is, right?

UNGER: Right.

MACKIE: Okay, well thank you so much, Alicia, for your reporting. Is there anything else that you’d like listeners to know before we hear your full story in Spanish?

UNGER: One thing that is very important: Not having a regular migratory status is an excuse not to do your taxes.

MACKIE: It’s not an excuse.

UNGER: It’s not an excuse. There is always a way that you can declare what you have made, and that is with the ITIN number. If you don’t have it, get it. If your ITIN number is expired, go with the volunteers in the library and they will help you to renew it.

MACKIE: And so everyone can be served through the library program regardless of their immigration status?

UNGER: Correct.

MACKIE: Okay great. And we’ll go ahead and listen to the story now.

UNGER: Yes. Let’s listen.