Subscribe to Jackson Unpacked. Available wherever you get your podcasts.

Nanci Turner Steveson and her 41-year-old son Parker Steveson settle down for the evening in their two-bedroom apartment at Pioneer Homestead in East Jackson. It’s Teton County’s only subsidized housing complex for senior and disabled citizens.

Parker Steveson stands in front of the Teton range, where he worked as a tour guide after surgery. He first visited in 8th grade on a school trip from Maryland. “I knew then, I was like, ‘I want to be there,’” he said. “I’ve been pretty privileged.” (Courtesy photo)

Nanci, 67, is a children’s book author. Parker works part-time as front of house and the front desk for Jackson’s Center for the Arts, where he’s also a volunteer DJ at KHOL.

Nanci is a proud horse-girl and all-around animal lover. Parker finds peace in long drives and photography in the nearby national park. These aren’t unusual descriptors for Jackson, Wyoming. Also not unusual: their struggle with housing.

Nanci has never owned a home and is a single mother to two sons, working several different jobs across the states before settling in Teton County 13 years ago where he’s been a renter ever since. The market in Jackson has meant rent hikes and landlords suddenly announcing she had to be out.

Measuring just her publishing deals, Nanci is a traditionally successful author. But she still contends with a childhood describes as “very troubled.”

A survivor of sexual abuse, she dropped out of high school and didn’t go to college. She suffered from an eating disorder. Though she’s been sober for over 30 years, she knew at 14 years old that she was abusing alcohol.

“I mean, you name it,” she said, “I had it.”

Parker has lived with disabilities for nearly his whole life, starting when he was born with a defective duct in his pancreas. In 2009, Parker was on life support, his belly open for eight months in the hospital. Painkillers and confinement blur his memories of the time. Nanci remembers that three pulmonologists were in charge of the emergency room. Two of them told her repeatedly he would not live.

Nanci Turner Steveson displays a photo of herself on horseback at 13. She was 9 years old when she first read the 1877 novel “Black Beauty,” which is narrated by a horse. “I remember closing it and thinking, when I grow up, I’m going to be an author and I’m going to write for kids. My books can have horses in them,” she said. (Sophia Boyd-Fliegel / KHOL)

Parker’s bill walking out of the hospital then was over $1 million, he said. While insurance paid most of that, he’s been in and out of the hospital ever since, including abdominal reconstruction in 2017, and hasn’t always had insurance.

To pay for necessities, like electricity bills, while paying for various medications for Parker, Nanci has accrued about $11,000 in credit card debt, she said.

The mounting debts have been demoralizing, especially when not being able to work consistently due to medical complications.

“You know, you look at the deficit and you’re like, well, I don’t give a s—- about those,” Parker said, who moved in with his mom in August 2023 following a depressive episode after his last surgery.

In 2024, Nanci got a life changing call. She had been selected for a home with the Greater Teton branch of Habitat for Humanity.

Nanci describes being selected as something of divine intervention, a network of “angels” looking out for her. There is, however, lots of earthly work to come.

Habitat homes are heavily subsidized and the organization helps secure no-interest mortgages on homes for families making relatively low salaries. For a household of two in Teton County, that’s between $31,944 and $85,184. But the homes are not free.

A down payment and closing costs will be about $4,000 for Nanci and Parker. They expect their monthly mortgage to be about $1,200.

Nanci and Parker meet with their financial advocate, Margi Barrie, once a month in the library. Barrie advises the pair on how to pay off their debts over time, sometimes by working side jobs. (Sophia Boyd-Fliegel / KHOL)

Once a month, Nanci and Parker work with real estate agent and Habitat volunteer Margi Barrie, who is helping the pair bring their debt to below one third of their household income.

“These guys had some milestones this month,” Barrie said at their February meeting, smiling and nodding with pride.

All Habitat homeowners will take anywhere from nine to 15 classes on homeownership, on everything from the difference between renting and owning, budgeting, home repairs, understanding mortgages, said Dawn Pruett, who chairs the regional chapter’s board.

In 25 years as a lender, Pruett has met with countless people seeking a mortgage in the free market who need similar front-end education.

“Though they were qualified, they didn’t have experience or education with regard to the process and what might change in their lives,” she said.

The Greater Teton Habitat has 73 families currently housed, Pruett said. That will grow to 85 following the completion of the Parkside development, where Nanci and Parker will live. It’s a public-private partnership between Habitat and the Jackson/Teton County Housing Department. About 10 repurchases or resales have happened over the lifetime of the regional branch.

Pruett said her board is discussing how to get similar classes out to the public.

The question now in Jackson, is can the approach scale. With all nonprofits tapping into the same pools of philanthropy, the community is holding its breath as the organization anticipates ramping up operations. On the horizon is the county’s largest development, northern South Park, where 70% of homes will be deed-restricted as affordable for those who live and work in the community. Habitat is one of two nonprofit partners anticipated to build out approximately 400 homes in the first round of development.

If the development happens as planned, Nanci and Parker could become examples for future families seeking stability.

With his mom and medical care nearby, Parker is starting to think about staying in one place. That means he can think of his life in terms of weeks, a big change from the day-to-day of the hospital.

“I’ve learned to look at what’s around me today and be a little more aware of that,” he said, “and a little more grateful for it.”

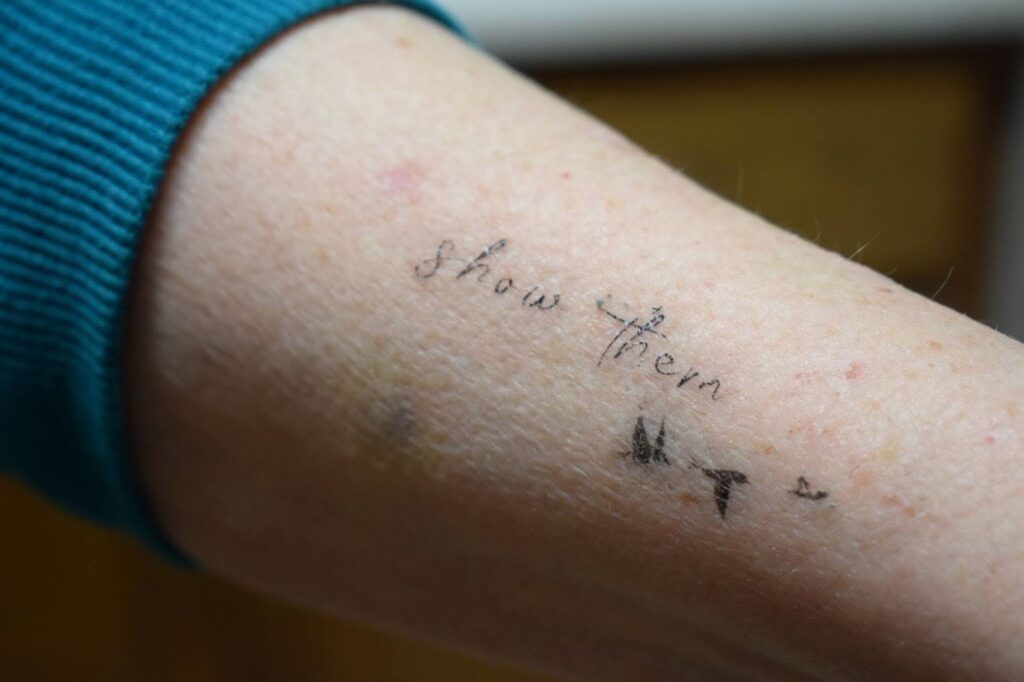

Nanci is a successful author by many measures, with publishing deals at major houses. But she still contends with a childhood she describes as “very troubled.” She had this temporary tattoo made permanent on April 1, 2025. (Sophia Boyd-Fliegel / KHOL)

Standing in the kitchen she will soon leave for one of her own, Nanci pulled up the sleeve of her sweater. In looping cursive it reads, “show them.”

Asked who “they” are, the author doesn’t skip a beat.

“All of the people that said I’d never amount to anything,” she said.