Rick Jansen describes himself as a semi-retired blue-collar worker. He’s worked in carpentry for the majority of his career and grew up in Teton County.

“We made a little stint and moved to Denver for a short period of time, [a] very short period of time. And we decided we did not like city life,” Jansen said. “So, we came back to Jackson and we’ve been here in Jackson ever since.”

Jansen finished building his current home south of town in 1980. It has a workshop off to the side of the garage, where an elk he recently shot was hanging out to dry when KHOL went to visit. Jansen said he’s seen a lot of changes in town but that he has no intentions of leaving the area if he can help it.

“No matter how much development that goes on, they can’t change the mountains. They can’t change the lakes,” he said, “and they can’t change the beauty of the area.”

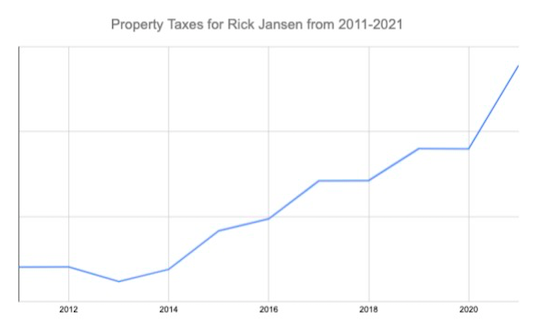

Jansen’s record shows that his property taxes have gone up 125% over the past 10 years. (Data courtesy of Rick Jansen. Exact numbers hidden for privacy.)

However, Jansen’s worried that forces outside of his control might force him to move. He’s been documenting his property taxes for a decade, and they have more than doubled since 2014. Just last year, his check went up nearly 30%. That’s a trend he said is becoming too much for a lot of his peers who are asset rich but cash poor.

“We’ve gone to a lot of garage sales this past summer, and I’ve talked to the owners because I know who they are, and I ask them, ‘Why are you leaving?’ And they say, ‘We’re tired of paying the property taxes,’” Jansen said. “They can’t afford it. So, they’ve sold their house for a good sum of money. And now they’re leaving.”

Jansen is 74 years old. He makes some income by remodeling houses and from social security checks, but he said that if he ever sold his Jackson home the cash he’d make wouldn’t support his lifestyle unless he left the area.

“I’m actually working for the taxman, really, because I’m trying to make enough money through the year to be able to pay the taxes when the tax bill is due,” he said. “And this year we had some additional expenses, and so that’s why I did not have enough to cover my taxes for the year. And my brother stepped in and helped me pay them.”

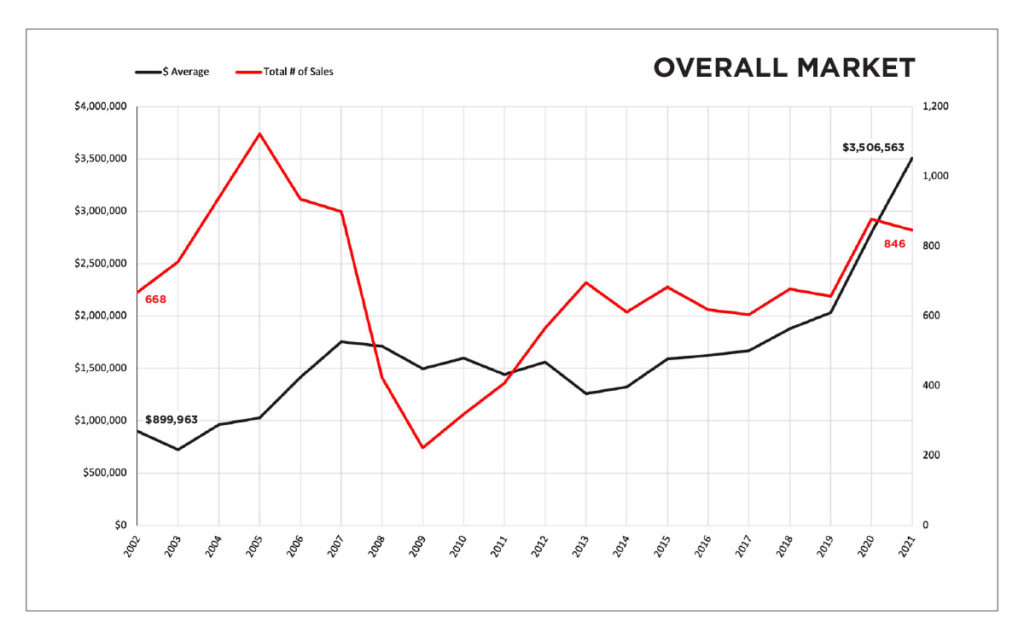

Teton County Assessor Melissa Shinkle said home values, depending on what area of Jackson Hole they’re in, have doubled, tripled, or in some cases quadrupled since she took office about four years ago. In 2021, the total number of real estate transactions actually went down compared to 2020. But the total sales volume increased – to the tune of 84%, according to one report.

“I think people are going to be very upset when they open their assessments this year,” Shinkle said, summarizing the situation.

Nearly $3 billion in total real estate sales was recorded in Jackson Hole in 2021 – a massive increase despite there being fewer total transactions than in 2020. (Data courtesy of the Jackson Hole Real Estate Report)

Part of Shinkle’s job is to monitor real estate sales, property deterioration and land usage. Then, by law, she makes an accurate assessment of what a market price would be for any particular property. But values are rising so quickly that it’s breaking her typical models she uses for calculations, and lots of folks are calling her office to say their annual bills are getting unsustainable.

“People have struggled. People always struggle, but it just didn’t seem to be at the level that it is now,” Shinkle said. “And I think that is why, especially now, the [state] legislature has got to look at some alternatives for people, because they’re going to lose their homes.”

The State of Wyoming used to have a property tax refund program that folks could apply for, but it hasn’t been funded for several years due to budget cuts. However, that might change during the upcoming legislative session. Democratic State Rep. Mike Yin of Jackson is proposing a county optional refund program that could help offset market forces.

As written, the program has a couple of caveats, including that people have to have been a resident of their home for five years or more, as well as occupy the property for more than nine months out of the year. Yin explained why those rules are on the table during a revenue committee meeting in mid-December.

“We don’t need to grant refunds to second homeowners because second homeowners aren’t at risk of being kicked out,” Yin said. “The intent here is [to help] the people who have lived in the community for a long time and are at risk of being forced to sell their house and being kicked out of their homes.”

Other county assessors across the state also argue that now is a pertinent time to pass this kind of bill. Similar efforts are in the works in places like Minnesota and New York, too, in order to counteract the national trend of rising home values.

For her part, Shinkle said the intent behind Yin’s bill is a good one. As assessor, she sometimes hates feeling like the bad guy for sending people a higher bill every spring.

“I can look at things and say, ‘This isn’t right.’ And morally and ethically, it kills me because I know what it’s going to do to that neighborhood and how it’s going to affect those people. They’re being forced to sell,” she said. “Even though they’re going to make a bajillion dollars, you know, in Teton County, that’s not what they want to do. They’ve raised their children here. They’ve had businesses here. And now they’re faced with having to move because they can’t afford their home. And that’s terrible. That should not be happening.”

“If I sell out and everybody else in the fixed income, blue-collar workers like me, sell out, all it’s going to be is the billionaires,” Jansen said. “And they’re going to have to take turns mowing each other’s grass, I guess, and cleaning their toilets, because there [aren’t] going to be any workers here.”

Jansen is hopeful a relief bill will pass. But he also said that in order for it to work for him, it would need to be a meaningful amount of support – and something he can rely on long-term. Meanwhile, at least one Jackson elected official, Vice Mayor Arne Jorgenson, has already testified in favor of Yin’s bill.