Charlotte DiPrisco is an elementary school counselor who grew up in Jackson. At 34, she and her fiancé, Ben, are looking to buy a home of their own and potentially start a family. But over the past six months they’ve been looking, they haven’t been able to find anything they can afford.

“Like, we’ve looked at condos that are $900 grand. And they’re two-bedroom, one bath, and they need work,” DiPrisco said. “That’s just not feasible for us.”

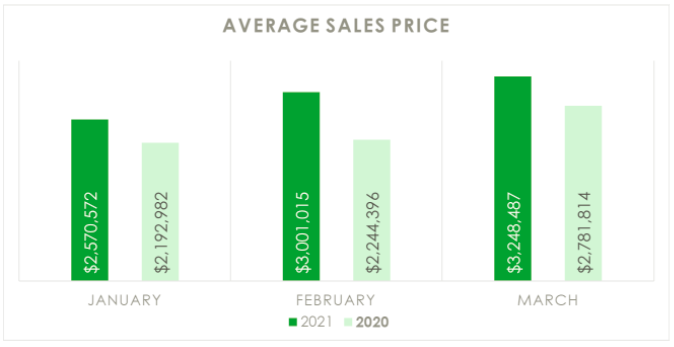

The average sales price of a single-family home in Jackson Hole was about $4.3 million dollars in the first quarter of 2021, according to a recent market report. Katie Brady has been working in Jackson real estate for more than a decade, and she said the local demand for houses has skyrocketed since the second half of 2020.

“Things are moving extremely fast, especially in the sub-$1 million market,” Brady said. “Properties are getting half a dozen to a dozen offers within the first day or so. It’s extremely competitive. And a lot of that has to do with the limited inventory.”

The average sales price for all properties in Jackson Hole compared year over year. Current upward trends are expected to continue for the rest of 2021. (Screenshot courtesy of Katie Brady Real Estate)

Real estate agent Katie Brady specializes in selling homes under $1 million. (Courtesy of Katie Brady)

Brady said there are only a handful of properties under $1 million available in Jackson at any given time. But that’s still way too expensive for the majority of area residents, including DiPrisco, who has also been looking for options through the local affordable housing department. But that hasn’t worked out either.

“We want to be here, but we make too much money for an affordable housing unit. But we can’t afford a free market. So we’re stuck in this limbo, this gray area where we don’t fit in one category or another,” DiPrisco said.

Educators, police officers and even doctors are struggling to make a life for themselves in Jackson, often commuting more than an hour over a mountain pass just to keep their jobs. Meanwhile, the gap between a starter home price and even relatively high-income earners in town is growing larger by the day.

That’s where April Norton comes in.

“We’ve seen households that could afford a $3,000 or $4,000 or $5,000 monthly payment, but they don’t have $100,000 cash sitting around to throw at something. And that’s been a real barrier for them,” Norton said.

Norton is the first director of the Jackson/Teton County Housing Department. On Feb. 1 of this year, she helped launch the Preservation Program, which helps local workers pay a higher down payment on a home so that they can get a more reasonable mortgage. The pilot grants up to $150,000 for every family accepted into the program.

April Norton is housing director for the Jackson/Teton County Affordable Housing Department. (Will Walkey/KHOL)

“It all seems like a win-win for the folks who want to stay here and live here and own here,” Norton said. “And also for the long-term sort of viability of workforce housing in the valley.”

In return for the assistance, Teton County puts a cap on the appreciation value of the home once it’s sold, making sure that it remains affordable over time. It also establishes a permanent restriction on the property: whoever lives there must make the majority of their income in Jackson Hole.

“The point of that is just to make sure that we’re not getting what we love to call ‘modem cowboys’ coming in and applying for and getting workforce homes,” Norton said. “We really want to provide housing for people who need to be here to do their jobs.”

Norton said another benefit is that it helps protect existing housing stock from being redeveloped into mansions. That was part of the inspiration behind the model that Jackson’s program is based on in Vail, Colorado. George Ruther is the housing director in Vail, where he started a program called Vail InDEED back in 2017.

George Ruther has been the housing director for the Town of Vail since 2015. (Courtesy of George Ruther)

“We’ve come to grips at least a long time ago that we’re not going to build our way out of this problem. And, in fact, for every new home we were building within the town of Vail, we were losing additional homes through the second homeowner type of market,” Ruther said. “So, we sought to come up with a program that had a focus on protecting and preserving some of those existing dwelling units in the Town of Vail.”

Jackson’s effort isn’t exactly the same, but the general outcome—investing cash into deed-restricted housing specifically for the local workforce—is. And in Vail, it’s been really successful.

“We spent about $11 million on 170 deed restrictions. And we provided housing for 350, 360 individuals in the town,” Ruther said.

Other resort communities, from Breckenridge, Colorado, to lakeside towns in Michigan have adopted similar programs. And some early evidence seems to indicate that they’re working: Two years after Vail InDEED began, an economic study found that the town’s investment in housing yielded a 5% return for local taxpayers.

“It’s no different than roads, bridges, streets, utilities, schools, fire departments, etc.,” Ruther said. “Meaning, without housing for our year-round residents, we’re not achieving our vision of being the premier international resort community.”

Townhomes on Meadow Ridge Road in Vail, Colorado, that were converted to deed-restricted properties through Vail InDEED. (Courtesy of George Ruther)

Jackson has not yet seen that success. Just three families have used the down payment assistance program thus far. DiPrisco applied and was accepted into it, but she said that $150,000 in help wasn’t enough.

“I feel like if someone was listening to this that didn’t live here and didn’t know what it was like, they’d be like, ‘Are you serious?’ But it barely made a dent,” she said. “That’s so sad.”

So, the young couple is going another route, building a small guest house on a property owned by DiPrisco’s family. Norton said their experience illustrates how difficult it is for her department to compete with out-of-towners with cash, even with the payment assistance. That’s why she’d like to have more resources akin to Colorado, a higher-tax state.

Ruther said it’s important to create relationships with the real estate brokerage community to find more properties quickly and to stay as nimble as possible when securing funding. The Jackson/Teton County Affordable Housing Department is currently surveying the local community, looking for more information about how the program can improve. Regardless, Norton is confident that down payment assistance will pick up speed in Jackson. It’ll just take time.

“I think that there are quite a few people in the community who want to do the right thing,” she said. “They want to see their home where they’ve raised their families to go to another family or go to another individual who wants to be here.”

Norton said she currently has another $500,000 or so, with another $2 million potentially coming soon, to help get Jackson’s Preservation Program off the ground.

This story is part of a collaboration between Rocky Mountain Community Radio and the Solutions Journalism Network highlighting housing solutions across the Mountain West. Stay tuned throughout this summer and fall for more stories from our partner stations.

A market-rate home under construction in Jackson, Wyoming. To the right is Teton County’s Affordable Housing Department. (Will Walkey/KHOL)